Green efforts progress and evolve but acceleration needed

It needs to be full steam ahead for the decarbonization of shipping, which is thought to contribute almost 3% of global greenhouse gas (GHG) emissions annually [1]. If it were a country, the shipping industry would be considered the sixth largest [2] emitter.

In 2018, the International Maritime Organization (IMO) committed to cut annual GHG emissions from international shipping by at least half by 2050, compared with their level in 2008, and work towards phasing out all GHG emissions from shipping as soon as possible in this century. It also set a goal to reduce the carbon intensity of international shipping by at least 40% by 2030, and 70% by 2050.

‚ÄúDecarbonization is by far the biggest challenge¬†for the sector, but the shipping industry‚Äôs efforts¬†are progressing and rapidly evolving,‚ÄĚ Īū≥śĪŤĪŰ≤ĻĺĪ≤‘≤űŐżCaptain Rahul Khanna, Global Head of Marine¬†Risk Consulting at –«Ņ’īę√Ĺ Global Corporate¬†& Specialty (AGCS). ‚ÄúThe pace and progress¬†of these efforts are influenced by a range of¬†factors, including technological developments,¬†regulatory frameworks, and market forces.‚ÄĚ

One key indicator of progress is the reduction in¬†carbon intensity, which is the amount of carbon¬†emissions per unit of transport work (such as¬†per ton-mile). ‚ÄúThe IMO‚Äôs target of reducing the¬†shipping industry‚Äôs carbon intensity by 40% by¬†2030, compared to 2008 levels, is ambitious and¬†the industry will need to accelerate its adoption¬†of energy-efficient technologies and fuels, such¬†as wind propulsion, biofuels, hydrogen, and¬†ammonia,‚ÄĚ Khanna explains.

AGCS pilots ESG Transportation Index

–«Ņ’īę√Ĺ has committed to transition all greenhouse¬†gas (GHG) emissions from its underwriting portfolios¬†to net-zero by 2050 consistent with a maximum¬†temperature rise of 1.5¬įC in order to contribute to the¬†implementation of the Paris Agreement on Climate¬†Change. Additionally, it is actively engaging with¬†clients on their own decarbonization strategies.¬†One pilot project that –«Ņ’īę√Ĺ Global Corporate &¬†Specialty (AGCS) is running in 2023 is the AGCS ESG¬†Transportation Index, which involves collaborating¬†with selected clients in the marine cargo and hull¬†sectors (as well as in the aviation industry) on a survey¬†to gather much-needed data on the maturity of¬†companies‚Äô environmental, social, and governance¬†(ESG), and sustainability initiatives and commitments.¬†

Once the pilot is completed the aim of the index is to offer access to up-to-date information on ESG best practices and trends, and benchmarking, which measures the ESG maturity of companies against industry peers, with the longer-term goal of developing sustainable insurance products and services. AGCS will also offer discussions to support clients’ sustainability agendas and additional risk consulting based on the results of the index.

Another indicator of progress is the adoption of regulatory frameworks aimed at reducing emissions. The IMO has introduced a range of measures to promote energy efficiency and reduce emissions, including the Energy Efficiency Design Index (EEDI), the Ship Energy Efficiency Management Plan (SEEMP), and the Carbon Intensity Indicator (CII). The CII regulations have come into force from January 1, 2023, and this should help accelerate the pace of transition.

Market forces are also driving decarbonization efforts in the shipping sector. Increasingly, consumers and investors are demanding sustainable and low-carbon supply chains, and shipping companies are responding by adopting cleaner technologies and fuels. New ships with engine propulsion using biofuels and methanol are already in the service. The availability and affordability of such low-carbon fuels will also play a significant role in the sector’s decarbonization efforts and in part is dependent on upstream producers.

Establishing green corridors is also an idea gaining in popularity. These are dedicated routes or lanes where special measures are taken to promote sustainable shipping and are collaborations between industry stakeholders such as shipping companies, ports and local authorities.

‚ÄúOverall, while progress has been made in the¬†shipping sector‚Äôs decarbonization efforts, much¬†more needs to be done to achieve the targets¬†set by the IMO,‚ÄĚ says Khanna. ‚ÄúWe also need¬†to keep in mind these targets are less ambitious¬†than the net zero target being set by many other¬†industries and IMO will face further pressure to¬†revise these.‚Ä̬†

According to Justus Heinrich, Global Product¬†Leader Marine Hull at AGCS, the sector‚Äôs¬†decarbonization journey will also have¬†significant implications for exposure and¬†underwriting: ‚ÄúThe big shipping companies have¬†solid controls and steering measures to reduce¬†carbon intensity, and many are in the process¬†of modernizing their fleet, retrofitting existing¬†vessels, testing alternative fuels, and ordering¬†new greener vessels.‚ÄĚ

Investment in alternative fuels takes off

Shipping companies and cargo operators are already switching to vessels powered by liquefied natural gas (LNG), as well as trialing and using alternative fuels, wind-assisted propulsion systems, more efficient propellers and bulbous bow designs. Meeting the International Maritime Organization (IMO) greenhouse gas emission reduction targets will cost as much as $1.4trn, according to a 2020 study from the Global Maritime Forum. [3]

Much of the current activity is focused on¬†experimenting with alternative fuels, including¬†biofuels, methanol, ammonia and hydrogen¬†power, as well as solar and battery powered¬†all-electric vessels and hybrid propulsion¬†systems. ‚ÄúWe are seeing a lot of investment¬†in alternative fuels. The challenge is to find¬†the one that will take us across the line and¬†meet decarbonization targets,‚ÄĚ says Captain¬†Rahul Khanna Global Head of Marine Risk¬†Consulting at –«Ņ’īę√Ĺ Global Corporate &¬†Specialty (AGCS) ‚ÄúLNG is helping transition¬†away from the heavy fuels of the past. But it is¬†not the solution that will take us there and will¬†only provide short-term temporary relief.‚ÄĚ

According to the IMO, [4] some 99.89% of the fuel¬†used by shipping in 2021 was carbon-based,¬†yet for the shipping industry to meet a 1.5¬įC¬†target in line with the Paris Agreement, net¬†zero-emission fuels must make up 5% [5] of the¬†international shipping fuel mix by 2030.

AGCS is already supporting ship owners as they test and transition to alternative fuels, in particular biofuels. Derived from agriculture and forestry, biofuels can replace conventional shipping fuel without substantial modifications to engines, fuel tanks, pumps or supply systems. However, there are likely to be challenges with scalability and sustainability, with questions over the ability of the supply chain and logistics to meet growing demand for biofuels.

Transitioning away from carbon-based shipping¬†will involve a challenging period of adjustment¬†and change, according to Khanna. ‚ÄúIt will take¬†years to build the scale of infrastructure required¬†to support the transition to alternative fuels,¬†and a mix of fuels is likely to exist for the next¬†five to 10 years, which poses a challenge for¬†shipowners and operators, ports, and bunker¬†operators,‚ÄĚ says Khanna.¬†

The shipping industry also has only limited experience of using and handling biofuels, while the long-term effects of alternative fuels on engines and fuel systems have yet to be borne out.

‚ÄúIncreasing the efficiency of vessels is a move¬†welcomed by insurers, which share the industry‚Äôs¬†commitment to decarbonization and net zero¬†targets. However, this is a new field that our¬†customers are exploring, and as insurers we¬†share in the risks. However, while there is an¬†increase in testing, we have very little data or¬†loss history on alternative fuels,‚ÄĚ says Justus¬†Heinrich, Global Product Leader Marine Hull¬†at AGCS. ‚ÄúCollaboration is key when it comes¬†to exposure and innovation and regular data,¬†experience and information exchanges with a¬†willing client base that wants to partner with us¬†will go a long way towards improving this.‚ÄĚ

While the testing of biofuels is already well underway, the industry is also exploring other potential low-carbon or zero-carbon fuels, including hydrogen, green methanol and ammonia, as well as battery-powered vessels.

‚ÄúAs yet we have not seen any major claims¬†from alternative technologies like wind-assisted propulsion or alternative fuels like¬†biofuel. However, bigger changes lie ahead.¬†As hydrogen, green methanol, ammonia and¬†battery-assisted technologies are introduced at¬†scale, then we will potentially see more issues,‚ÄĚŐż≤ű≤Ļ≤‚≤ű R√©gis Broudin, Global Head of Marine¬†Claims at AGCS.

Dutch logistics company Samskip recently ordered two hydrogen-powered feeder container vessels while Norwegian ferry line Torghatten Nord is developing hydrogen-powered ferries. [6]

Shipping companies are also ordering vessels capable of running on green methanol. Almost two-thirds of new container ship orders this year will be capable of using green methanol. [7]

‚ÄúHydrogen and ammonia have been touted¬†as possible fuels that could help meet¬†decarbonization targets, but it is early days in¬†terms of the additional risks these fuels present¬†to the industry, especially once they start mass¬†production of such vessels. Hydrogen and¬†ammonia are not easy to handle, and hydrogen,¬†in particular, is difficult to transport,‚ÄĚ says¬†Khanna. In February 2023, a report [8] by the¬†Australian Transport Safety Bureau revealed¬†than an electrical failure blamed on incorrect¬†fitting work caused a ‚Äúserious‚ÄĚ incident during¬†the world‚Äôs first international transport of¬†liquefied hydrogen in January 2022. A one-meter-high yellow flame erupted from a gas¬†combustion unit on the liquefied hydrogen¬†carrier but there was no subsequent fire,¬†explosion or injuries.

Electric and autonomous vessels bring benefits and new risks

Last year, the world’s first fully electric, autonomous container ship, the Yara Birkeland, completed its maiden voyage, sailing along the Norwegian coast from Horten to Oslo. By the end of this year, the number of crew on board the 80m-long vessel could be halved, [9] and potentially removed completely within two years, if trials go according to plan.

The builder of the Yara Birkeland, Kongsberg, is also now developing battery-powered autonomous barges for Norwegian grocery wholesaler Asko. In Sweden, the city of Stockholm is due to commence electric autonomous car ferries by mid-2024, [10] although they will be remotely controlled from the shore, and will still have crew on board empowered to take over control if needed. The city also has plans to pilot an electric hydrofoil commuter ferry later this year.

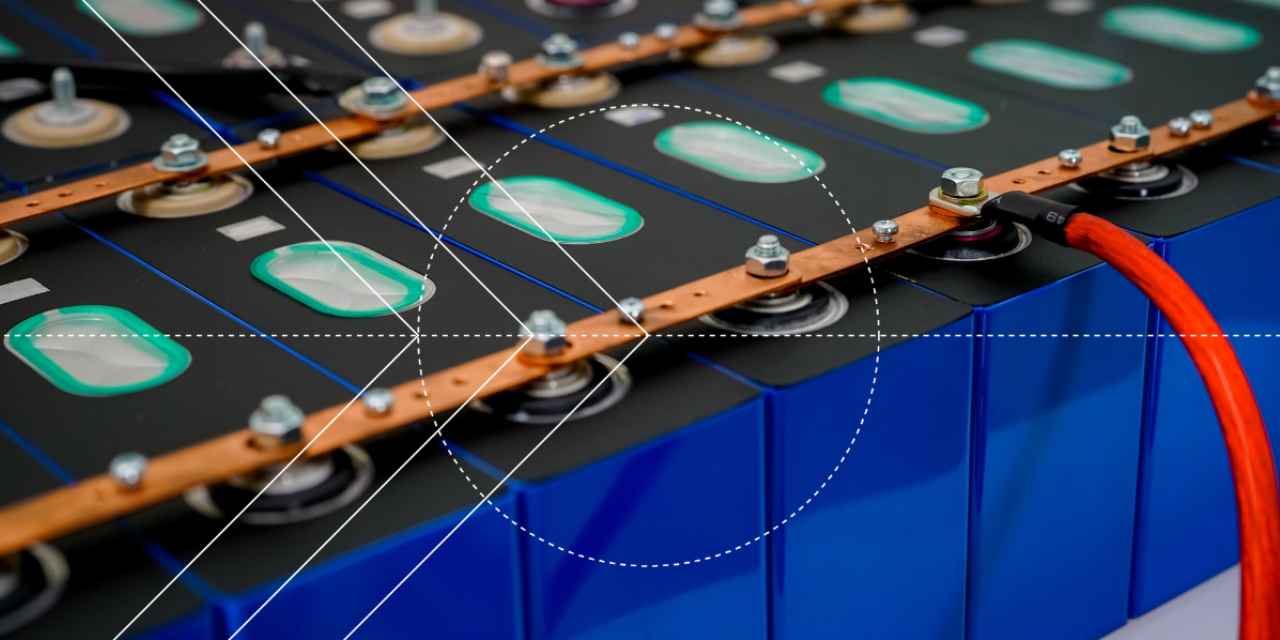

The lithium-ion (Li-ion) batteries used in electric¬†vessels are an important risk factor, Īū≥śĪŤĪŰ≤ĻĺĪ≤‘≤űŐżCaptain Nitin Chopra, Senior Marine Risk Consultant at –«Ņ’īę√Ĺ Global Corporate &¬†Specialty (AGCS). Container ship and car-carrier fires in recent years have highlighted¬†that these batteries can combust or explode¬†when damaged, or due to faulty manufacturing.¬†Battery fires are also more difficult to extinguish¬†and prone to self-reigniting.¬†

‚ÄúThe battery power banks, if damaged, could¬†cause a serious fire. It is well documented that¬†Li-ion battery fires are very hard to extinguish¬†and require additional firefighting measures.¬†As electrification moves to larger vessels, it will¬†require special measures for fire protection and¬†fighting, especially in the battery storage area,‚ÄĚŐż≤ű≤Ļ≤‚≤ű Chopra.¬†

Fire detection, prevention and fighting capabilities will be an important consideration in the development of safe operation of electric-powered vessels, explains Chopra. Crew training and procedures will also need to reflect the potential fire risks.

While electric and autonomous vessel development has so far focused on smaller coastal vessels, the technology could be deployed in larger ocean-going vessels. Last year, a subsidiary of South Korean shipbuilder HD Hyundai completed the world’s first ocean crossing by a large autonomous ship. The LNG carrier Prism Courage [11] sailed 10,800 nautical miles from Texas to South Korea in 33 days, of which half was navigated autonomously.

‚ÄúCoastal trade has provided a good testing¬†ground for this technology, and from an insurance¬†perspective, we would like to see continued testing¬†with smaller coastal vessels, learning and refining¬†systems over time, before moving on to scaled-up¬†ocean transit operations,‚ÄĚ says Chopra.

With no crew on board, autonomous technology¬†raises questions around emergency response,¬†Chopra adds. ‚ÄúIf there was a cargo or engine fire,¬†collision or grounding, any event, small or large,¬†would be amplified and potentially turn into a¬†total loss.‚ÄĚ

The International Maritime Organization’s Maritime Safety Committee is in the process of developing new regulations for the operation of maritime autonomous surface ships (MASS), including the role, competencies and responsibilities of MASS master and crew, The aim is to adopt a non-mandatory goal-based MASS Code to take effect in 2025, which will form the basis for a mandatory goal-based MASS Code, expected to enter into force on January 1, 2028.

References

[1] OECD and International Transport Forum, Ocean shipping and shipbuilding

[2] OCEANA, Shipping pollution

[3] Global Maritime Forum, The scale of investment needed to decarbonize international shipping, January 20, 2020

[4] International Maritime Organization, Energy efficiency of ships, September 10, 2022

[5] COP26 Climate Champions, UMAS, Shipping needs 5% zero-carbon fuels by 2030 to meet green goals, March 9, 2021

[6] Cruise & Ferry, Torghatten Nord develops two hydrogen-powered ferries, March 6, 2023

[7] Splash247.com, Methanol boxship orders growing more rapidly than all other fuel types, March 1, 2023

[8] TradeWinds, Report reveals serious incident on Shell hydrogen carrier’s maiden voyage, February 2, 2023

[9] BBC, Crewless container ships appear on the horizon, March 24, 2023

[10] HDI, Autonomous and electric ferries set course for Sweden, April 13, 2023

[11] gCaptain, South Korean company claims world’s first autonomous ocean crossing by a large ship, June 7, 2022

Pictures: AdobeStock